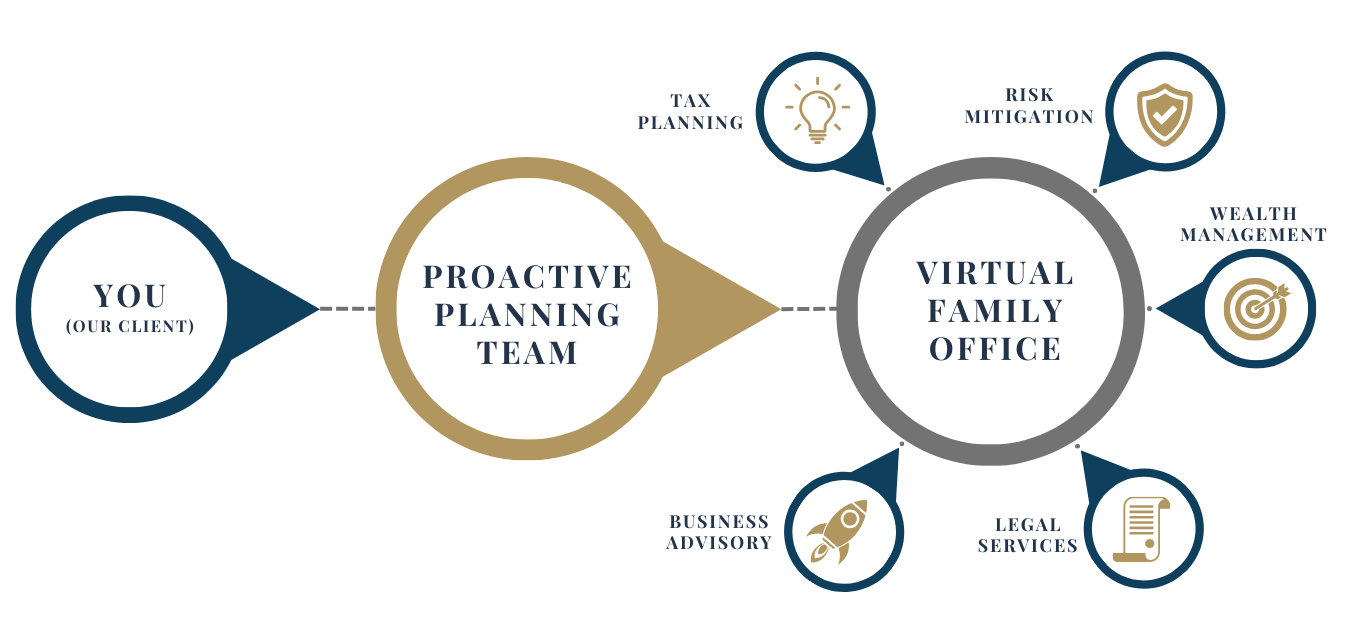

One team. One vision. Every facet of your financial world, streamlined — that’s the Family Office advantage.

Once reserved for ultra-high-net-worth individuals and large corporations, our family office model is now accessible to top-earning professionals, thriving business owners, and families with a net worth of $2–20 million.

We work with your existing tax professional to enhance mitigation strategies that go beyond the typical annual return preparation. What to expect:

- Access to a team of tax experts in specialized fields

- Cross reviewed by legal teams and industry compliance advisors

- Advanced tax mitigation on income, estate, capital gains, and asset depreciation.

- Pro-active tax planning through deep research of the tax code as it applies to your unique situation.

A common mistake among even the most successful investors and businesses is overlooking risk mitigation. We design balanced structures that protect your gains, safeguard your business, and preserve long-term success. How we do it:

- Risk tolerance score identification

- Comprehensive review of existing assets paired with forward-looking risk planning.

- Implementation of strategic insurance solutions that align with your business or personal financial goals - limiting downside exposure.

- Focused on the most cost-effective solution possible by accessing the entire market as opposed to working with a captive firm.

A 401(k) or IRA alone is not a comprehensive wealth plan. We take wealth accumulation a step further, adding layers of risk and tax mitigation, to protect and preserve what you’ve built. Here’s how:

- Tax-conscious Roth conversion strategies on a recurring annual basis.

- 401(k) divesting to tax-deferred accounts with a broader investment optionality.

- Asset performance backtesting based on the current portfolio allocations model.

- Aligning your wealth management goals with Risk Tolerance and all other estate or business-related assets.

Working in tandem with your existing counsel or independently, our legal services team addresses both business and personal needs — simplifying communication and ensuring every decision stays aligned with your overall plan.

- Starting a business - entity formation, contract drafting, compliance review, IP rights protection

- Estate Planning - creation of a Trust and guidance on the structure of that Trust.

- Buying or selling Real Estate: title searches, contract review, and transaction support.

- Lawsuites: support in legal case building and incout testmonial support.

Running a successful business brings inevitable challenges — and scaling adds even more complexity. We provide the perspective, innovation, and strategic support needed to turn obstacles into opportunities.

- Analyze market trends, assess risk, and identify opportunities that align with your objectives

- Perform financial audits to identify inefficiencies and optimize cash flow management - increasing the bottom line.

- Support in marketing - understand the target market, identify marketing channels, and develop effective strategies.

- Developing and identifying growth opportunities that you overlooked and evaluating the feasibility of new market ventures, as it aligns with your overall risk tolerance.

- HR support in how to effectively and legally handle employee engagement issues.

- Support in identifying, tracking, and optimizing important business KPIs that may be sliding.